What is a stock redemption? What are some of the reasons for making a stock redemption? Why are some redemptions treated as sales and others as dividends?

What will be an ideal response?

A stock redemption is the acquisition by a corporation of its own stock. Some reasons for a redemption are listed on pages C:4-16. Some redemptions that substantially change the shareholder's proportionate interest closely resemble a sale of stock to a third party and are treated as a sale or exchange, while others that do not produce such a change are essentially equivalent to a dividend and are taxed as a dividend.

You might also like to view...

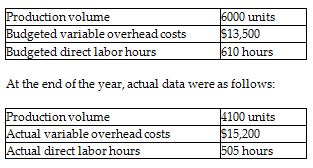

Stafford Company uses standard costs for its manufacturing division. Standards specify 0.1 direct labor hours per unit of product. The allocation base for variable overhead costs is direct labor hours. At the beginning of the year, the static budget for variable overhead costs included the following data:

How much is the standard cost per direct labor hour for variable overhead? (Round your answer to the nearest cent.)

A) $22.13 per direct labor hour

B) $32.93 per direct labor hour

C) $26.73 per direct labor hour

D) $24.92 per direct labor hour

Financial accounting

a. is primarily concerned with internal reporting. b. is more concerned with verifiable, historical information than is cost accounting. c. focuses on the parts of the organization rather than the whole. d. is specifically directed at management decision-making needs.

For a weighted application blank to be effectively used, individual factor scores (for education, experience, and so on) must be correlated with such criteria as job turnover and high job achievement

Indicate whether the statement is true or false

The normal distribution curve is ______.

A. skewed to the left of the mean B. skewed to the right of the mean C. symmetrical about the mean D. linear