A budget will

A) improve your credit standing so you can use borrowing to increase your current consumption.

B) All of the above.

C) help you focus on those expenditures that you value highly relative to cost.

D) make it more attractive for you to buy a car every couple of years.

C) help you focus on those expenditures that you value highly relative to cost.

You might also like to view...

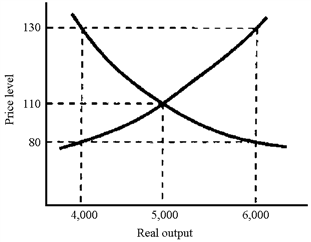

Figure 10-4

In Figure 10-4, if full employment occurs at an output level of 4,000 and the economy is currently at an output level of 5,000 then we can expect a(n)

a.

increase in autonomous consumer spending that shifts the aggregate demand curve to the left.

b.

increase in wages that will shift the aggregate supply curve to the left.

c.

decrease in investment spending that shifts the aggregate demand curve to the left.

d.

decrease in wages that will shift the aggregate supply curve to the left.

In order for isoquants to have a diminishing marginal rate of substitution, they must be:

A. L-shaped. B. vertical. C. straight lines. D. None of the statements is correct.

The Laffer curve illustrates that:

A. high tax rates could lead to lower tax revenues if economic activity is severely discouraged. B. lowering tax rates will always increase tax revenues. C. high tax rates would increase tax revenue and increase the labor supply as people work harder to maintain their standard of living. D. lowering tax rates will always decrease tax revenues.

Entrepreneurs are important to market economies because

A) they engage in risk taking and innovation. B) they make up a large portion of low-skilled labor. C) they take few risks and thereby, suffer fewer bankruptcies. D) they represent the bulk of employment at large corporations.