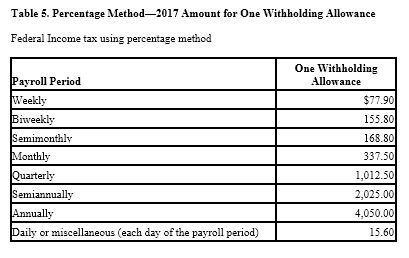

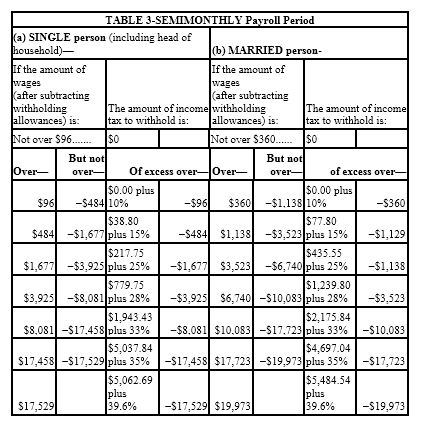

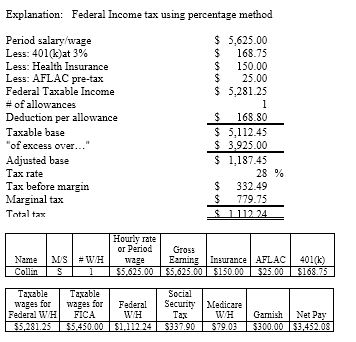

Collin is a full-time exempt employee in Juneau, Alaska, who earns $135,000 annually and has not yet reached the Social Security wage base. He is single with 1 withholding allowance and is paid semimonthly. He contributes 3% per pay period to his 401(k) and has pre-tax health insurance and AFLAC deductions of $150 and $25, respectively. Collin has a child support garnishment of $300 per pay

period. What is his net pay? (Use the percentage method. Do not round interim calculations, only round final answer to two decimal points.)

A) $3,353.05

B) $3,452.08

C) $3,274.60

D) $3,585.14

B) $3,452.08

You might also like to view...

Your coach thinks Daniel should be the team leader because Daniel is strong, confident, and intelligent. The coach is using which viewpoint of leadership?

A. process B. management C. trait D. power

Hospitality organizations have used the concept of theming to ______.

a. reduce the cost of constructing the hospitality environment b. add value to the guest experience and enhance it c. entertain the employees so that they work harder d. implement an effective, low-cost price strategy

Which of the following is not a characteristic of a process costing system?

A) A specific time period is used B) Several Work in Process Inventory accounts are used C) Product costs are grouped by processes, departments, or work cells D) Customized products are manufactured

Credit cards are commonly used to pay for items such as clothing, car repairs, or a new car

Indicate whether the statement is true or false.