What is the expected variance for the stock?

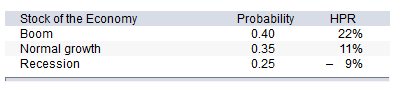

You have been given this probability distribution for the holding-period return for a stock:

A. 142.07%

B. 189.96%

C. 177.04%

D. 128.17%

E. None of the options are correct.

E. None of the options are correct.

Variance = [0.40 (22 10.4)2 + 0.35 (11 10.4)2 + 0.25 (-9 10.4)2] = 148.04%.

You might also like to view...

Inventory carrying costs include all of the following except:

a. clerical cost of ordering goods b. opportunity cost of investment funds c. insurance costs d. obsolescence and deterioration

Accelerated Logistics provides the following information:

What is the company's profit margin ratio? (Round your answer to two decimal places.)

A) 14.29%

B) 10.71%

C) 75.00%

D) 27.90%

As a firm's product moves along the product life cycle, marketing managers can expect all of the following to occur EXCEPT

A. the necessity of changes to the firm's marketing mix. B. increasing industry profits until total product sales finally reach their decline. C. a shift in the competitive environment toward pure competition or oligopoly. D. potential changes in customers' attitudes and needs. E. total product sales peaking at the market maturity stage.

Wilson Wholesale, has credit terms of 1/10 net 30. Customers should take the discount and pay in 10 days if they CANNOT earn more than ________ (APR) on their investments

A) 13.01% B) 20.13% C) 18.43% D) 12.29%