If your taxable income was $50,000 and you had an average tax rate of 20 percent, how much tax did you pay?

What will be an ideal response?

$10,000

You might also like to view...

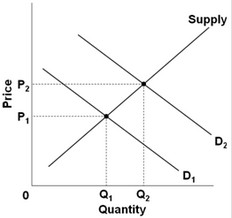

Use the following graph for a market to answer the question below. Which of the following would best explain why the shift in demand from D1 to D2 would cause price to rise from P1 to P2?

Which of the following would best explain why the shift in demand from D1 to D2 would cause price to rise from P1 to P2?

A. After the shift in the demand, there would be a surplus at price P2. B. After the shift in the demand, there would be a shortage at price P1. C. After the shift in the demand, there would be a surplus at price P1. D. After the shift in the demand, there would be a shortage at price P2.

The U.S. national debt at the end of fiscal year 2014 was almost

A. $13.5 trillion. B. $9.0 trillion. C. $18 trillion. D. $1.3 trillion.

The public assistance program that economists believe can promote economic equality at the least cost in economic efficiency is

a. Aid to Families with Dependent Children (AFDC). b. a negative income tax (NIT). c. food stamps. d. Medicaid.

Which of the following were prominent among the protesters at the WTO meeting in Seattle in late 1999?

A. international bankers that free trade undermined underdeveloped nation's ability to pay back loans. B. environmentalists concerned that corporations would locate in countries that had very lax environmental standards. C. multinational corporations concerned that free trade condoned sweatshop working conditions. D. All of the choices were prominent in the Seattle protest.