The larger the fraction of an investment financed by borrowing

A) the greater the potential return and the smaller the potential loss on that investment.

B) the smaller the potential return and potential loss on that investment.

C) the greater the potential return and potential loss on that investment.

D) the smaller the potential return and the greater the potential loss on that investment.

C

You might also like to view...

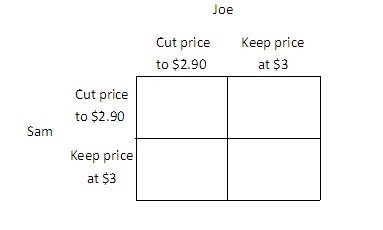

Joe is the owner of the 7-11 Mini Mart, Sam is the owner of the SuperAmerica Mini Mart, and together they are the only two gas stations in town. Currently, they both charge $3 per gallon, and each earns a profit of $1,000. If Joe cuts his price to $2.90 and Sam continues to charge $3, then Joe's profit will be $1,350, and Sam's profit will be $500. Similarly, if Sam cuts his price to $2.90 and Joe continues to charge $3, then Sam's profit will be $1,350, and Joe's profit will be $500. If Sam and Joe both cut their price to $2.90, then they will each earn a profit of $900. You may find it easier to answer the following questions if you fill in the payoff matrix below.

width="383" />If both players choose their dominated strategy they will each earn ________, and if both players choose their dominant strategy they will each earn ________. A. $900; $1000 B. $1000; $900 C. $500; $1350 D. $900; $1350

We can draw demand curves for firms in perfectly competitive and monopolistically competitive industries, but not for oligopoly firms. The reason for this is

A) perfectly competitive and monopolistically competitive firms sell standardized products. Oligopoly firms sell differentiated products. B) there are no barriers to entry in perfectly competitive and monopolistically competitive industries. There are high barriers to entry in oligopoly industries. C) we can assume that the prices charged by perfectly competitive and monopolistically competitive firms have no impact on rival firms. For oligopoly this assumption is unrealistic. D) that perfectly competitive and monopolistically competitive firms are price takers. Oligopoly firms are price makers.

If the money supply is 500 and velocity is 6, then nominal GDP:

A. is 500. B. is 83.33. C. is 3,000. D. cannot be determined.

Madison, the CPA, is faster than Mason, the house painter, at both accounting services and painting. This means that:

A. there is no reason for them to trade services. B. Madison should trade her accounting services for Mason's painting services, so long as Madison is relatively more efficient at accounting services. C. Madison should trade her accounting services for Mason's painting services, so long as Madison is relatively more efficient at painting. D. Madison has the comparative advantage in both services.