Vertical equity holds that

A. those with equal ability to pay should bear unequal tax burdens.

B. those with equal ability to pay should bear equal tax burdens.

C. those who benefit the most from governmental services should bear the higher tax burden.

D. those with greater ability to pay should pay more.

Answer: D

You might also like to view...

In addition to promoting innovation, what is another benefit of government investments in R&D?

a. Creating new industries and jobs b. Reducing tax rates for private firms c. Establishing sources of public goods d. Reducing the number of free riders

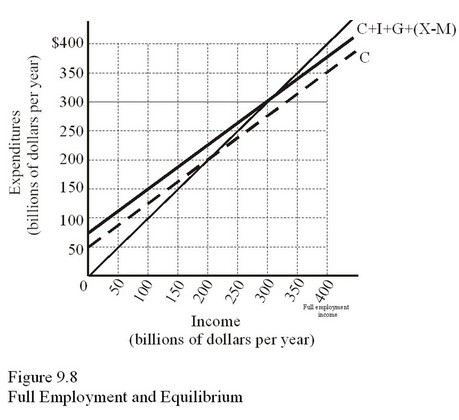

In Figure 9.8, if full-employment income is produced at $400 billion, we can expect inventories to

A. Rise as a result of undesired inventory investment. B. Fall as a result of undesired inventory investment. C. Rise as a result of undesired saving. D. Fall as a result of undesired saving.

Households derive the majority of their income from

A. government transfers. B. property. C. inherited wealth. D. wages and salaries.

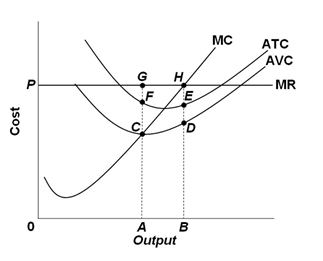

Refer to the graph below for a purely competitive firm. When the firm is in equilibrium in the short run, the amount of economic profit per unit is:

A. EH

B. DE

C. DH

D. DB