Why are bonds less risky than stocks?

a. The dividend given on shares is usually less than the coupon-rate on bonds.

b. Bonds can be issued only by the government whereas shares are issued by private firms.

c. Bondholders have a claim on the assets of the firm whereas the shareholders do not.

d. Shareholders are entitled to a share of the company's earnings.

e. The higher the profit of the firm, the greater the share of the bondholders.

c

You might also like to view...

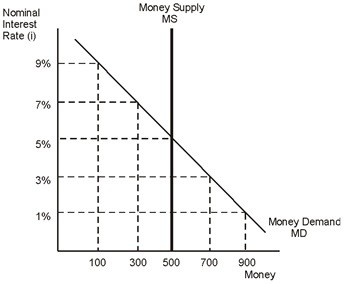

Refer to the figure below. If the Federal Reserve wants to set the nominal interest rate at 9%, it must conduct open market ________ to set the money supply at ________.

A. sales; 100 B. purchases; 900 C. purchases; 100 D. sales; 900

Financial capital is highly volatile, and technological advances have reinforced this volatility

Indicate whether the statement is true or false

Using the ISLM model, explain and show graphically the effect of a fiscal expansion when the demand for money is completely insensitive to changes in the interest rate. What is this effect called?

What will be an ideal response?

Suppose that the production function for the economy is Y = AK0.5L0.5. If the capital stock = 40,000, the quantity of labor = 10,000, and the efficiency index = 3, the equilibrium real wage is

A) $3. B) $4.50. C) $9. D) $16.67.