Professionals are required to deliver services but the competency of the services is never an issue.?

Indicate whether the statement is true or false

False

You might also like to view...

Which of the following represents the correct ordering of standard deviation of returns over the

period 1926 to 2014 (from highest to lowest standard deviation of returns)? A) common stocks, long-term government bonds, long-term corporate bonds, Treasury bills B) Treasury bills, long-term government bonds, long-term corporate bonds, common stocks C) Treasury bills, long-term government bonds, common stocks, long-term corporate bonds D) Treasury bills, long-term corporate bonds, long-term government bonds, common stocks

Without creating a separate business organization, Reynold starts up, and assumes the financial risk of, Sole Savers, a new, pre-owned auto sales enterprise. Reynold is? A) a partner

B) a franchisor. C) a franchisee. D) a sole proprietor.

Global ______________ management system provides the ability to locate, track and predict the movement of every component or material anywhere upstream or downstream in the supply chain.

Fill in the blank(s) with the appropriate word(s).

The firm's cost of a new issue of common stock is ________.

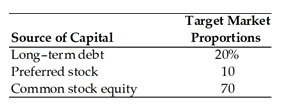

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

A) 7 percent

B) 9.08 percent

C) 14.2 percent

D) 13.4 percent