Assume a two-country, two-commodity, and two-input model. Let the two countries in this model be the United States and the Rest of the World and the two goods being produced by each of the countries be steel and wheat. The two factors of production used in producing the goods in each country are capital and land. If the United States is capital-abundant and steel production is capital-intensive, the Heckscher-Ohlin model would predict that the United States would

A. export wheat and import steel.

B. import both the goods from the Rest of the World.

C. export both the goods to the Rest of the World.

D. export steel and import wheat.

Answer: D

You might also like to view...

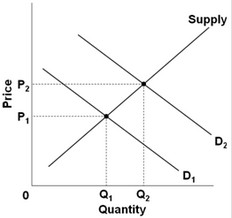

Use the following graph for a market to answer the question below. Which of the following would best explain why the shift in demand from D1 to D2 would cause price to rise from P1 to P2?

Which of the following would best explain why the shift in demand from D1 to D2 would cause price to rise from P1 to P2?

A. After the shift in the demand, there would be a surplus at price P2. B. After the shift in the demand, there would be a shortage at price P1. C. After the shift in the demand, there would be a surplus at price P1. D. After the shift in the demand, there would be a shortage at price P2.

Jill, an economics student, has already spent 5 hours cleaning her room. In deciding whether or not to continue cleaning for another hour, she applies the economic principle of

A) scarcity. B) ceteris paribus. C) choosing at the margin. D) productivity.

Suppose the United Auto Workers' Union succeeded in obtaining a 10 percent increase in the wages of its workers and that the wage increase caused automobile prices to rise. Employment in the auto industry would be most likely to decline significantly if

a. the demand for American-made automobiles was highly elastic. b. the supply of foreign-produced automobiles was highly inelastic. c. American consumers considered foreign automobiles a poor substitute for American automobiles. d. the demand for American automobiles was relatively constant and highly inelastic.

An important antitrust concern about new companies such as Google and Facebook is that they:

A. do not have incentives to innovate. B. use data on their customers to direct ads. C. charge monopoly prices for their services. D. benefit from first-mover advantage.