Answer the following statement(s) true (T) or false (F)

1. In the United States, the National Emission Standards for Hazardous Air Pollutants (NESHAP) are set to reach the maximum reduction of each toxic achievable, which is known as the maximum achievable control technology (MACT).

2. A State Implementation Plan (SIP) outlines procedures for a state to implement, monitor, and enforce the NAAQS but not the NESHAP.

3. Air Quality Control Regions (AQCRs) are those geographic areas in the United States identified as having met all air quality standards.

4. Air quality in the United States is monitored either by estimating emissions levels or by measuring pollutant concentrations.

5. Environmental justice is an equity criterion that has increased in importance over time in U.S. policy decisions.

1. True

2. False

3. False

4. True

5. True

You might also like to view...

Explain when a country would face a balance of payments deficit and when it would face a balance of payments surplus if it was operating under a fixed exchange rate system

What will be an ideal response?

While making a purchase decision using marginal thinking, a buyer should buy the good that yields the:

A) highest marginal benefit per dollar spent. B) lowest marginal benefit per dollar spent. C) highest average benefit plus marginal benefit per dollar spent. D) lowest average benefit plus marginal benefit per dollar spent.

A perfectly inelastic demand curve is

A) a horizontal straight line. B) a vertical straight line. C) a downward sloping straight line that intersects the horizontal axis at the origin. D) an upward sloping straight line that crosses the vertical axis.

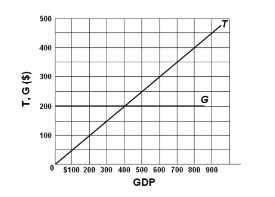

Refer to the diagram in which T is tax revenues and G is government expenditures. All figures are in billions. In this economy:

A. tax revenues and government spending both vary directly with GDP.

B. tax revenues vary directly with GDP, but government spending is independent of GDP.

C. tax revenues and government spending both vary inversely with GDP.

D. government spending varies directly with GDP, but tax revenues are independent of GDP.