Discuss the role that companies like Standard & Poor's, Dun & Bradstreet, and Moody's play in solving the problem of adverse selection.

What will be an ideal response?

Adverse selection is a problem that stems from information asymmetry, specifically the inability to distinguish good quality from lesser quality. The rating agencies provide information on firms and give potential lenders/investors the ability to distinguish quality and avoid the problem of adverse selection.

You might also like to view...

Sweet Husks is a perfectly competitive corn farm. Currently, the expected price of an ear of corn is $0.40 and, at its current production level, Sweet Husks has a marginal cost of $.30 per ear. The expected profit from producing an additional ear of corn is ________.

A) $0.10 B) $0.70 C) $0.20 D) $0.40

Activists believe that monetary and fiscal policy will only work if it comes as a surprise to the public

a. True b. False Indicate whether the statement is true or false

If over a short time a large number of teenagers become old enough to find employment and a much smaller number of people retire, then productivity

a. and real GDP per person rise. b. rises but real GDP per person falls. c. falls but real GDP per person rises. d. and real GDP per person fall.

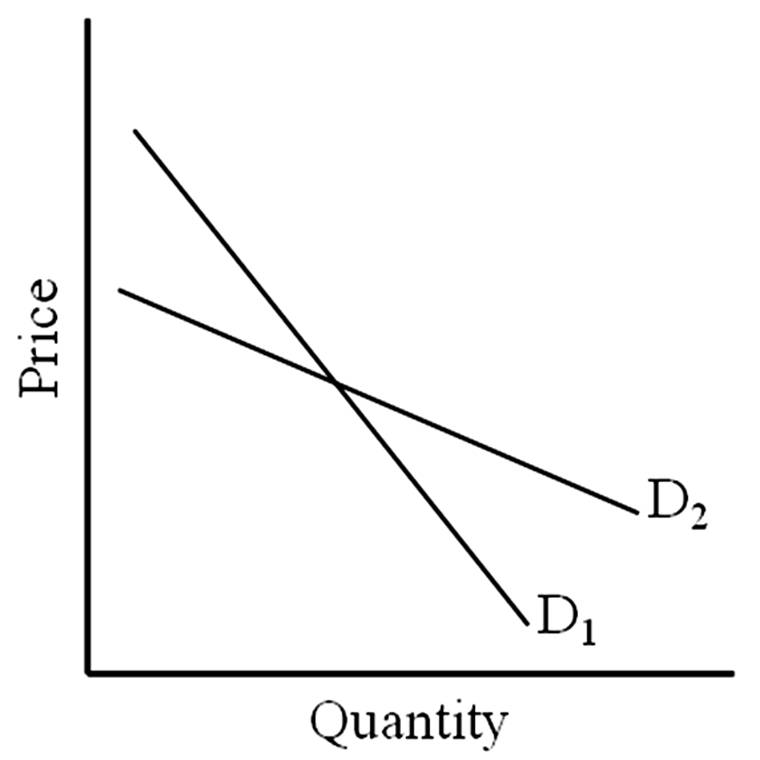

Which statement is true?

A. D1 is more elastic than D2.

B. D2 is more elastic than D1.

C. D1 and D2 have the same elasticity.

D. There is no way to determine the relative elasticities of D1 and D2.