Sweet Husks is a perfectly competitive corn farm. Currently, the expected price of an ear of corn is $0.40 and, at its current production level, Sweet Husks has a marginal cost of $.30 per ear. The expected profit from producing an additional ear of corn is ________.

A) $0.10

B) $0.70

C) $0.20

D) $0.40

A) $0.10

You might also like to view...

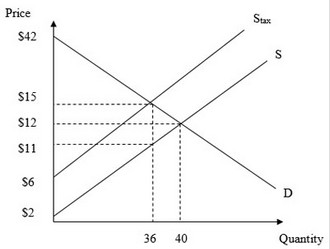

Use the figure below to answer the following question. What is the amount of producer surplus after the government imposes the excise tax on the market?

What is the amount of producer surplus after the government imposes the excise tax on the market?

A. $162 B. $540 C. $486 D. $180

Which of the following provides the clearest example of human capital?

A) Automated equipment that can be used without any accompanying human labor B) Corporate stock owned by individuals and families rather than institutions such as mutual funds or corporations C) Machinery that has been designed and constructed by human beings D) Tools that cannot be used effectively except in combination with workers E) The ability to read

A surplus will occur in a market if:

A. the quantity supplied at a given price exceeds the quantity demanded at that price. B. the quantity demanded at a given price is less than the quantity supplied at that price. C. there are not enough sellers at the prevailing price. D. there are too many buyers at the prevailing price.

Suppose you know a piece of land will be worth $1 million (real) in 2045, and the real interest rate is 5%. About how much should you be willing to pay for the land today (2015)? (Assume no taxes)

a. $610,000 b. $1 million c. $1.89 million d. $230,000