When federal government spending exceeds tax revenues, the federal government runs a budget surplus.

Answer the following statement true (T) or false (F)

False

You might also like to view...

Which of the following statements concerning income and substitution effects is not true?

a. Income and substitution effects cause the demand curve to slope downward. b. When the price of a good falls, real purchasing power increases and consumers can purchase more of all goods. c. The substitution effect describes the situation in which more of the good whose price has fallen is purchased, and less of all other goods is purchased. d. A price decrease of one good cannot cause the income effect. e. Income and substitution effects are related to diminishing marginal utility and consumer equilibrium.

If the price buyers pay rises by the full amount of the tax, the burden...

What will be an ideal response?

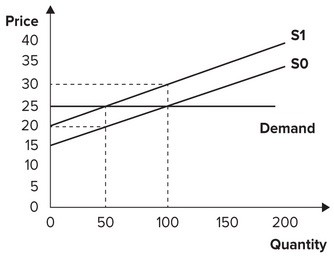

Refer to the graph shown. Initially, the market is in equilibrium with price equal to $25 and quantity equal to 100. As a result of a per-unit tax imposed by the government, the supply curve shifts from S0 to S1. The effect of the tax is to:

A. raise the price consumers pay from $25 to $30. B. lower the price sellers keep after paying the tax from $25 to $20. C. lower the price consumers pay from $25 to $15. D. raise the price sellers keep after paying the tax from $25 to $30.

Which of the following was not a contributing factor to the housing market boom of the 2000s?

A. Mortgages with no or little money down B. Scant concern given to people's ability to meet the mortgage payment C. Low interest rates D. The merging of large banks giving them more assets