Which of the following helps the reader locate information in the research report?

A) letter of transmittal

B) executive summary

C) table of contents

D) introduction

E) auto search function tab

C

You might also like to view...

______ is the sum of the differences between the actual and the forecasted demand values.

A. Mean squared error (MSE) B. Mean absolute deviation (MAD) C. Mean absolute percentage error (MAPE) D. Cumulative sum error (CSE)

A major advantage of investing in mutual funds is that ________

a. the judgment of the fund managers may be wrong b. you pay fees to the money managers c. the fund managers do the hard work of research and diversification d. the fund managers ignore diversification

Ignoring income taxes and any minority interest effects, what is the amount of unrealized profit remaining from the intercompany sale of equipment at December 31, 2018?

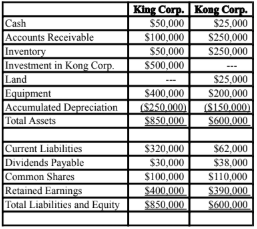

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, which it acquired on January 1, 2018. The Financial Statements of King Corp. and Kong Corp. for the Year ended December 31, 2018 are shown below:

Income Statements

Retained Earnings Statements

Balance Sheets

Other Information:

> King sold a tract of Land to Kong at a profit of $10,000 during 2018. This land is still the property of Kong Corp.

> On January 1, 2018, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

> On January 1, 2018, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2018, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

> Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

> Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

• Inventory had a fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2018.

• A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

• There was a goodwill impairment loss of $4,000 during 2018.

• Both companies are subject to an effective tax rate of 40%.

• Both companies use straight line amortization.

A) Nil. B) $15,000. C) $20,000. D) $10,000.

The Crimson Partnership is a service provider. Its assets consist of unrealized receivables (basis of $0, fair market value of $400,000), cash of $300,000, and land (basis of $200,000, fair market value of $300,000). Assume 20% general partner Jana has a basis in her partnership interest of $100,000 . If the ongoing partnership distributes $200,000 of cash to Jana in liquidation of her interest

in the partnership, she will recognize ordinary income of $80,000 and a capital gain of $20,000. a. True b. False Indicate whether the statement is true or false