All of the following statements about marginal benefit are correct EXCEPT the marginal benefit of a good

A) is the benefit a person receives from consuming one more unit of the good or service.

B) is measured as the maximum amount that a person is willing to pay for one more unit of the good.

C) is equal to zero when resource use is efficient.

D) decreases as the quantity consumed of the good increases.

C

You might also like to view...

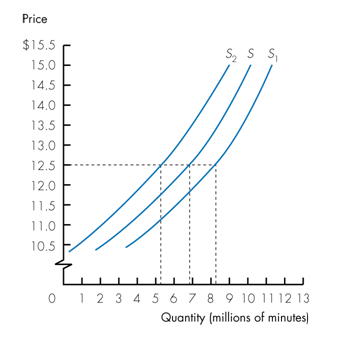

Refer to the following graph. An increase in supply is reflected as

a. a shift of the supply curve from S to S2.

b. a shift of the supply curve from S to S1.

c. a shift of the supply curve from S1 to S2.

b. a change in the quantity supplied from 6.8 to 5.2 million minutes when price is $12.50.

If a specific tax is implemented

A) the firm's average cost curve shifts up, resulting in lower profits. B) the after-tax marginal cost curve shifts, resulting in lower quantity produced. C) there is less profit per unit sold. D) All of the above.

Suppose that the government reduces income taxes. Which of the following is the most likely result?

a. An increase in human capital investment b. A decrease in consumption c. An increase in government spending d. A decrease in government spending e. A decrease in human capital investment

The three major components of a bond are the bond price, maturity date, and coupon rate

Indicate whether the statement is true or false