Identify which of the following statements is true.

A) A general partner's share of recourse debt is based on his or her economic risk of loss, and his or her share of nonrecourse debt is predominantly based on his or her share of partnership profits.

B) A partner's basis for his or her partnership interest is increased by his or her share of the partnership's tax-exempt income.

C) If all tax-exempt interest income is distributed when received by a partnership, the partners' bases are the same after the distribution as they were before the tax-exempt interest was received by the partnership.

D) All of the above are true.

D) All of the above are true.

You might also like to view...

In the context of the rational approach to organizational change, which of the following occurs when leaders act to optimize their part of the organization at the expense of suboptimizing the organization's overall effectiveness?

A. siloed thinking B. learning agility C. reframing D. expectation-performance gap

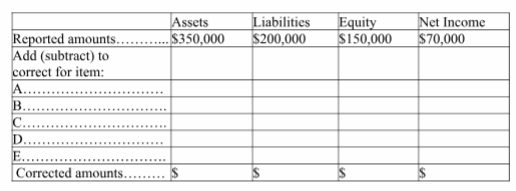

A company issued financial statements for the year ended December 31, but failed to include the following adjusting entries:

A. Accrued interest revenue earned of $1,200.

B. Depreciation expense of $4,000.

C. Portion of prepaid insurance expired (an asset) used $1,100.

D. Accrued taxes of $3,200.

E. Revenues of $5,200, originally recorded as unearned, have been earned by the end of the year.

Determine the correct amounts for the December 31 financial statements by completing the

following table:

The City of Brownsville had a balance in the Budgetary Fund Balance -- Reserve for Encumbrances account at the end of 2016 in the amount of $90,000. During 2017, all purchase orders related to the $90,000 were filled, and the invoice amount was $91,200. Which of the following would be true regarding the Statement of Revenues, Expenditures, and Changes in Fund Balances for 2017? (assume encumbrances do not lapse)

A. The amount shown for Expenditures would include only the $90,000. B. The amount shown for Expenditures would include only the $1,200. C. The amount shown for Expenditures would include the $91,200. D. The amount shown for Expenditures would not include items related to orders placed in 2016.

Which of the following elements ultimately determines the amount of audit work that is necessary in the circumstances to afford a reasonable basis for an opinion?

A. Materiality. B. Auditor judgment. C. Relative risk. D. Reasonable assurance.