White Hat Digital, Inc starts the year with a credit balance of $3,500 in its Estimated Warranty Payable account

During the year, there were $224,000 in sales and $4,800 in warranty repair payments. White Hat Digital estimates warranty expense at 2% of sales. At the end of the year, what is the balance in the Estimated Warranty Payable account?

A) $4,480 debit

B) $4,800 credit

C) $3,500 debit

D) $3,180 credit

D .Opening Balance of Estimated Warranty Payable $3,500

Add: Warranty Expense 4,480

Less: Warranty Repairs 4,800

Closing Balance of Estimated Warranty Payable $3,180

You might also like to view...

Which of the following represents the correct sequence of the three business activities on the Statement of Cash Flows?

a. Financing - Operating - Investing b. Investing - Operating - Financing c. Operating - Investing - Financing d. Financing - Investing - Operating

Which of the following statements is true regarding vertical analysis?

a. Common-size financial statements can be used to compare businesses of different sizes. b. Vertical analysis can only be used with balance sheet accounts. c. Vertical analysis can only be used with income statement accounts. d. Vertical analysis can only be used with retained earnings accounts.

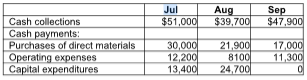

The cash balance on June 30 is projected to be $4500. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 4%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. Calculate the amount of principal repayment at the

Burchfield, Inc. has prepared its third quarter budget and provided the following data:

A) $5,000

B) $10,000

C) $15,000

D) $20,000

Which of the following is a correct statement?

A. Sales discounts are offered to compensate customers for unsatisfactory merchandise. B. Sales discounts may result in creating a liability Deferred Revenue. C. Sales discounts may result in creating an account Inventory-Estimated Returns. D. Sales discounts are offered to encourage prompt payment by customers.