Explain why asymmetric information can cause the real interest rate to increase, and why increases in the real interest rate can actually make lending more risky for financial institutions

What will be an ideal response?

Credit rationing exists because of asymmetric information, where financial institutions cannot perfectly observe the financial conditions of firms or the willingness of firms to repay loans. Increasing the real interest rate on loans is a way for financial institutions to compensate for the asymmetric information and the associated risk of lending. Increasing the real interest rate will cause good borrowers (those that are actually good credit risks) to drop out of the market, while the bad borrowers (those that are actually not good credit risks) remain. The pool of borrowers therefore becomes even riskier. Financial institutions can compensate for this additional risk by increasing real interest rates again, but this causes even more good borrowers to withdraw from the market.

You might also like to view...

How does adverse selection affect the economic efficiency of the used car market?

What will be an ideal response?

Knowing the value of the cross elasticity of demand allows us to distinguish between inferior goods and normal goods.

Answer the following statement true (T) or false (F)

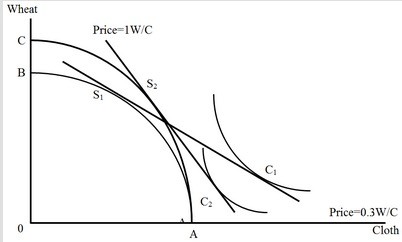

The figure below shows a shift in the production-possibility curve of a country from AB to AC. Here, S1 and C1 are the initial production and consumption points, respectively. S2 and C2 are the final production and consumption points, respectively. Which of the following is illustrated by this figure?

A. The benefits of trade in a small country B. The mechanism of reversal in trade pattern C. The immiserizing growth effect in a large country D. The validity of the product cycle hypothesis

Reasons for diseconomies of scale include: