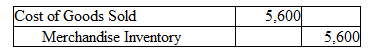

Countrywide Sales sold 400 units of product to a customer on account. The selling price was $28 per unit, and the cost, according to the company's inventory records, was $14 per unit. Prepare the journal entry to record the cost of goods sold. (Assume a perpetual inventory system and the FIFO inventory costing method.) Omit explanation.

Note:

Cost of Goods Sold = 400 units × $14 per unit = $5,600

You might also like to view...

Certain differences exist between IFRS and U.S. GAAP financial statement reporting. Which of the following is false?

A) ?IFRS presents a different ordering of the liabilities and shareholders' equity sections. B) ?IFRS allows the upward revaluation of property, plant, and equipment. C) ?IFRS does not require a statement of cash flows. D) ?IFRS financial statements are similar to U.S. GAAP.

Sid Tucker is a salesperson working for Shades, a cosmetic company. He offers a small basket filled with complimentary products from Shades' new line of winter makeup to the manager of a large department store. Identify the type of approach used by Tucker.

A. Introductory approach B. Complimentary approach C. Customer benefit approach D. Product approach E. Premium approach

The first step toward identifying the type of applicant to be recruited for a sales job is to:

A) determine the compensation plan B) consult the sales staff for recommendations C) determine the actual duties of the position D) develop personality and skills assessments E) search for applicants from traditional sources

Guinea, Inc. adopted the dollar-value LIFO retail inventory method on January 1, 2016, when the price index was 100. The following information was taken from company records on December 31, 2016, when the price index was 110. Cost Retail Sales $190,000 Additional markups 18,000 Markup cancellations 6,000 Markdowns 8,000 Markdown cancellations 2,000 Inventory, January 1$ 14,400 20,000 Purchases158,000 199,000 Purchase returns4,000 5,000 ? Required:Compute the cost of the December 31, 2016, inventory. (Round off calculations to the nearest dollar.)

What will be an ideal response?