Suppose the yen value of a $100,000 wheat import contract rises from ¥12,000,000 to ¥13,000,000 between the contract and the payment date. This implies that the yen value of 1 dollar has declined so that, other things equal, we can expect an increase in Japanese demand for U.S. goods

a. True

b. False

Indicate whether the statement is true or false

False

You might also like to view...

In the Gordon growth model, a decrease in the required rate of return on equity

A) increases the current stock price. B) increases the future stock price. C) reduces the future stock price. D) reduces the current stock price.

Dynamic open market operations

A) are aimed at achieving changes in monetary policy. B) are used much more frequently than defensive open market transactions. C) are used to offset disturbances to the monetary base. D) make it easy to deduce the Fed's intentions for monetary policy.

A straight-line production possibilities curve takes this shape because

A) the opportunity cost of producing a good is constant. B) the opportunity cost of producing more of a good is decreasing. C) resources are better suited for producing one output than another. D) resources are fixed.

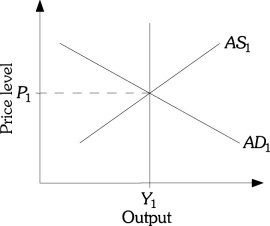

Refer to the information provided in Figure 32.2 below to answer the question(s) that follow. Figure 32.2Refer to Figure 32.2. According to the new classical economists, under rational expectations an expected increase in government spending would

Figure 32.2Refer to Figure 32.2. According to the new classical economists, under rational expectations an expected increase in government spending would

A. shift AD1 to the left. B. shift AD1 to the right. C. shift AS1 to the right. D. none of the above.