Depreciation is a process of cost allocation, not a process of valuation

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

When using a work sheet:

a. an equal number of account titles are applicable to the Income Statement columns and the Balance Sheet columns. b. adjusting entries are not made since they appear on the work sheet. c. net income appears in both the Income Statement debit column and the Balance Sheet credit column. d. the Income Statement column and Balance Sheet column of the work sheet eliminate the need to prepare formal financial statements.

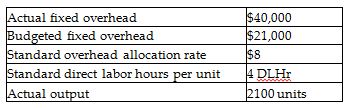

Family Fashions uses standard costs for its manufacturing division. The allocation base for overhead costs is direct labor hours. From the following data, calculate the fixed overhead volume variance.

A) $16,800 F

B) $46,200 U

C) $46,200 F

D) $16,800 U

"Kris, how are you handling the grapevine in your department? I'm sure that you and your employees are hearing the same disturbing rumors that we are hearing. My department is spending too much time exchanging gossip, and morale is very low," said Mike. Kris replied, "I strive to manage the grapevine. If I hear a story that might get out of hand, I talk to the ________ involved. I prevent rumors by dispelling ________. Finally, I ________ rumors once they have started."

A. key people; uncertainties; neutralize B. key people; rumormongers; deny C. key people; truth; neutralize D. rumormongers; uncertainties; propagate E. rumormongers; troublemakers; deny

Good Cookin' Products Company makes heat convection ovens. Heidi discovers that herGood Cookin'oven is defective and sues the maker for product liabil¬ity based on strict liability. To win, Heidi must show that she

a. bought the oven from Good Cookin'. b. did not misuse the oven. c. suffered an injury caused by the defect. d. did not know of the defect.