What is a constructive dividend? Provide several examples of the term

Constructive dividends generally occur in closely held corporations where dealings with shareholders are often informal. They result in an economic benefit to the shareholder from the corporation that are not labeled as a dividend. Constructive dividends have the same general Federal tax consequences as regular dividends. That is, the dividend is income to the shareholder, but not deductible by the corporation.

A number of different scenarios may lead to the determination that a constructive dividend has occurred. Amounts paid to a shareholder in excess of what the IRS considers reasonable may give rise to a constructive dividend. Personal shareholder expenses paid by the corporation without expectation of repayment can also be classified as constructive dividends to the shareholder in an amount equal to the fair market value of the benefit received.

Depending upon the facts and circumstances of the transaction, the IRS may attempt to treat a shareholder advance that is not a bona fide loan (e.g., poor or nonexistent documentation) as a constructive dividend. Interest on shareholder loans with below-market interest rates can also constitute a constructive dividend. Likewise, if a corporation, without adequate consideration, assumes a debt or other legal obligation of a shareholder, or makes payments on the debt, a constructive dividend may result.

Use of corporate property by shareholders can also result in a constructive dividend. Typical situations include the use of corporate-owned autos, boats, airplanes, vacation homes, and other property if the shareholder does not repay the corporation for the use of this property at a fair rental value.

In addition, the value of improvements made by the corporation to property leased from a shareholder that were in excess of normal lessee improvements (based on the type and value of the property and the term of the lease) can be a constructive dividend.

Finally, bargain purchases of corporate property by a shareholder can also result in a constructive dividend to the extent the FMV of the property exceeds the purchase price.

You might also like to view...

How can multichannel and omnichannel retailers reduce showrooming?

What will be an ideal response?

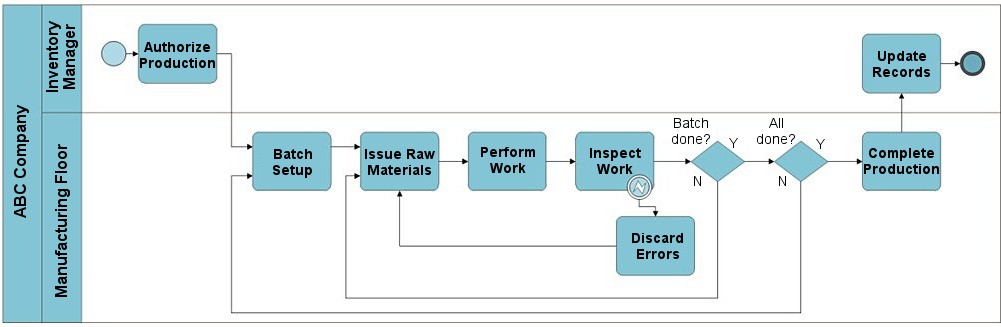

Review the conversion process BPMN activity diagram presented below. In the diagram, the symbol  indicates which of the following?

indicates which of the following?

A. Collapsed subprocess. B. Gateway. C. Exception event. D. Activity loop.

Interest margin to average total assets measures:

a. the balance between earning and nonearning assets. b. management's ability to control the spread between interest income and interest expense. c. the ability to borrow successfully. d. the proportion of debt to equity. e. the return on owner's investment.

Equity capital can be obtained from:

a. banks b. credit unions c. bondholders d. insurance companies e. retained earnings