Marley Company hired a consultant to help improve its operations. The consultant's report stated that Marley's inventory levels are excessive and cited several negative consequences to Marley as a result. Which of the following consequences was not cited in the report?

a. Possible other uses for working capital now tied up in inventory

b. Production stoppages due to parts not being available

c. Higher property taxes and insurance costs

d. Large quantities of obsolete materials

b

You might also like to view...

In 2020, the TransUnion Company had consulting revenues of $1,000,000 while costs were $750,000. In 2021, TransUnion will be introducing a new service that will generate $150,000 in sales revenues and $60,000 in costs. Assuming no changes are expected for the other services, operating profits are expected to increase between 2020 and 2021 by:

A. $150,000. B. $60,000. C. $250,000. D. $90,000.

A variable pricing strategy makes planning and forecasting much easier than a one-price strategy.

Answer the following statement true (T) or false (F)

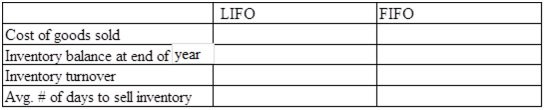

The following information relating to the current year was taken from the records of Poole Company: Beginning inventory200 units @ $110Purchase May 12100 units @ $120Purchase October 9150 units @ $125Sales360 units @ $180Required: a) Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to cost of goods sold, and how much to inventory at the end of the year. b) Based on your results from part (a), calculate inventory turnover and average number of days to sell inventory. c) Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to inventory at the end of the year. d) Based on your results from part (c), calculate inventory turnover and average number of

days to sell inventory. e) Compare your results from parts (b) and (d). Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

What will be an ideal response?

You hold the following portfolio, consisting of Assets A, B and C. What is the portfolio beta?

Asset Return Beta Portfolio Weight A 10% 0.75 0.20 B 12% 1.00 0.40 C 14% 1.25 0.40 A) 0.75 B) 1.00 C) 1.05 D) 1.15 E) 1.25