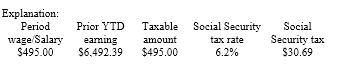

Adam is a part-time employee who earned $495.00 during the most recent pay period. He is married with two withholding allowances. Prior to this pay period, his year-to-date pay is $6,492.39. How much should be withheld from Adam's gross pay for Social Security tax?

A) $40.02

B) $30.69

C) $37.92

D) $28.46

B) $30.69

You might also like to view...

What bodily tendencies should a manager look for to detect dishonesty during the interview process?

a. lessened eye contact and increased blinking b. none, because they are not reliable c. lack of detail and pauses in responses d. odd breathing and sweating

Collaborative demand planning allows an organization to reduce the cost and time required during the design process of a product.

Answer the following statement true (T) or false (F)

Defining the compensable factors and scales to include the content of jobs held predominantly by women is one of the methods to ensure that job evaluation plans are bias-free.

Answer the following statement true (T) or false (F)

Recruiting and selection of salespeople should include enough steps to yield the information needed to make accurate selection decisions. However, the stages of the process should be sequenced so that the more expensive steps are

A. near the beginning. B. always completed before anything else. C. near the end. D. paid by the prospects rather than the company. E. never reached.