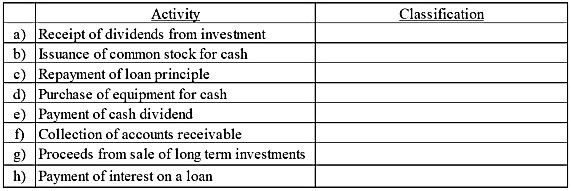

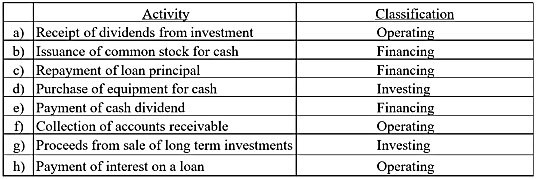

Consider each of the following activities. Required:Identify whether each of the following activities will be reported in the operating activities, investing activities, or financing activities section of the statement of cash flows.

What will be an ideal response?

You might also like to view...

What does the Financial Accounting Standards Board now call special purpose entities?

a. variable interest entities b. off-balance-sheet entities c. structured finance entities d. risk mitigation vehicles

Which is a form of job crafting?

A. changing the employee’s job description B. changing the quantity of output C. changing reporting structures within the organization D. changing cognitive task boundaries

To implement the marketing concept, a firm must first

A. mobilize its marketing resources. B. promote the product. C. obtain information about its customers' needs. D. develop the product. E. determine if customers want the firm to practice the marketing concept.

Identify each of the following payroll taxes as an (A) Employer Payroll Tax, (B) Employee Payroll Tax, or (C) Both. 1.FICA-Social Security taxes2.FICA-Medicare taxes3.FUTA (federal unemployment taxes)4.SUTA (state unemployment taxes)5.Employee federal income taxes6.Employee state and local income taxes

What will be an ideal response?