Double taxation of corporate earnings

A. tends to restrict the activities of corporate firms.

B. causes stockholders to earn a lower return than they would on other securities of comparable risk.

C. results in more investment in research and development.

D. All of these responses are correct.

Answer: A

You might also like to view...

In the ISLM framework, the impact of monetary policy on equilibrium income is less when

A) money demand = money supply. B) money demand is infinitely elastic. C) the interest rate is low. D) the investment function has lower interest-sensitivity.

The U.S. tax code

a. all of the reasons given as answers b. to social engineer c. to raise revenue for government spending d. is used to help politicians get elected.

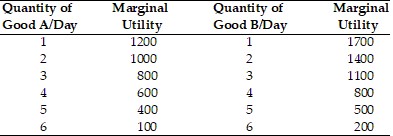

Refer to the above table. If the price of Good A is $2, the price of Good B is $1, and the consumer has $9, the rational consumer will purchase

Refer to the above table. If the price of Good A is $2, the price of Good B is $1, and the consumer has $9, the rational consumer will purchase

A. 6 units of Good A and 3 units of Good B. B. 5 units of Good A and 6 units of Good B. C. 2 units of Good A and 5 units of Good B. D. 6 units of Good A and 0 units of Good B.

Net interest payments by the government are usually

A. large and positive for both the federal, and state and local governments. B. small and sometimes negative for the federal government, but large and positive for state and local governments. C. small and sometimes negative for state and local governments, but large and positive for the federal government. D. small and sometimes negative for both the federal, and state and local governments.