Sean and Martha are both over age 65 and Martha is considered blind by tax law standards. Their total income in 2018 from part-time jobs and interest income from a bank savings account is $80,000. Their itemized deductions are $25,000.Required: Compute their taxable income.

What will be an ideal response?

| Salary & interest | $60,000 |

| Standard deduction [$24,000 + (3 × 1,300)] | (27,900) |

| Taxable income | $32,100 |

The standard deduction is increased because of age for both and blindness for Martha.

You might also like to view...

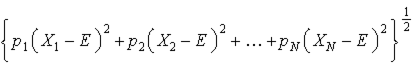

Suppose you are an investor with a choice between three securities that are identical in every way except in terms of their rates of return and risk. Which security has the least risk? Note: You can answer this question intuitively, without calculating the standard deviation. However, if you want to calculate the standard deviation, the equation is:

Standard deviation = S =

Popularity created by consumer word of mouth is called ________.

A. spin B. propaganda C. hype D. tweet E. buzz

Larry purchased a Leisure Lawnmower because the company salesperson intentionally misled him by assuring him that the mower was self-propelled, had a mulching feature, and had a five-year unlimited manufacturer's warranty. When Fred finds out that his new Leisure Lawnmower is not self-propelled, does not mulch, and has a 90-day warranty, he may successfully sue for

a. reformation of the contract only. b. restitution only. c. restitution and possibly punitive damages. d. compensatory damages only.

Congress passed the _____ thatbanned business relationships that might create conflicts of interest between certified public accounting (CPA) firms and the companies they audit.

A. Sarbanes-Oxley Act of 2002 B. Securities Exchange Act of 1934 C. Glass-Steagall Act of 1933 D. McCain-Feingold Act of 2002