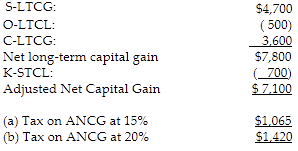

What are the tax consequences of these transactions, assuming his marginal tax rate is (a) 32% and (b) 37%? Ignore the medicare tax on net investment income.

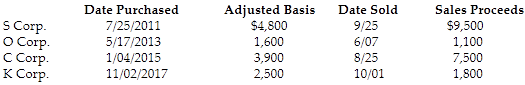

Mike sold the following shares of stock in 2018:

The net capital gain will be taxed at 15% or 20% depending upon the amount of the taxpayer's total taxable income.

You might also like to view...

Why do students need to study information technology?

A. Information technology is found in only a few businesses. B. Information technology is rarely discussed in business. C. Information technology is everywhere in business. D. Information technology is rarely used in organizations.

Purchaser Corporation acquires 30% of the outstanding voting common shares of the Investee Corporation for $600,000 . Purchaser Corporation acquires the investment in Investee Corporation by buying previously issued shares of Investee Corporation from other investors. When Purchaser Corporation acquired 30% of Investee Corporation's common shares for $600,000, Investee Corporation's total

shareholders' equity was $1.5 million. Purchaser Corporation's cost exceeds the carrying value of the net assets acquired by $150,000 [ $600,000 - (0.30 x $1,500,000)]. Purchaser Corporation attributes the $150,000 excess purchase price as follows: $100,000 to remeasure buildings and equipment to fair value and $50,000 to goodwill. Which of the following is/are true? a. Purchaser Corporation does not reclassify this excess out of its Investment in Stock of Investee Corporation account to Buildings and Equipment and to Goodwill. b. Purchaser Corporation must amortize (or depreciate) any amount attributed to assets with limited lives. c. Purchaser Corporation must depreciate the $100,000 attributed to buildings and equipment over their remaining useful lives. d. U.S. GAAP and IFRS do not permit the investor to amortize the excess purchase price attributed to goodwill and other assets with indefinite lives. Instead, the investor must test the investment account annually for possible impairment. e. all of the above

Choose the correct word in parentheses. The audience (is, are) rising for the national anthem

Answer the following statements true (T) or false (F)

1. The research is clear: high performance work systems such as quality circles, job rotation, teams, and total quality management decrease absenteeism and turnover and increase company profits. 2. American lean production practices are similar to those used in Japan in that decision-making is decentralized to give workers a greater say in what ultimately gets decided. 3. The constant drive to achieve reduced inefficiencies through lean processes has been called, "management by stress" by critics of the lean production philosophy. 4. In Saturn's self-directed work teams, teams of 6-15 union employees were empowered to make business decisions about business planning, technology, pricing, and new product development. 5. The Saturn plant in Spring Hill, Tennessee, is an example of the successful implementation of self-directed work teams in a traditional scientific management-based industry.