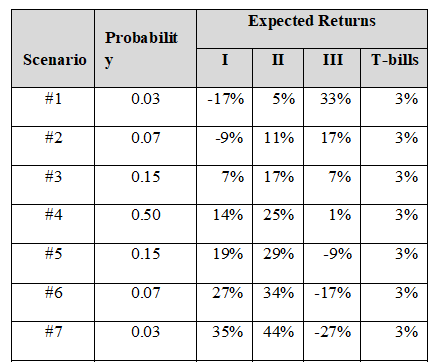

The following table contains the probability distribution for the returns of three securities over the next year.

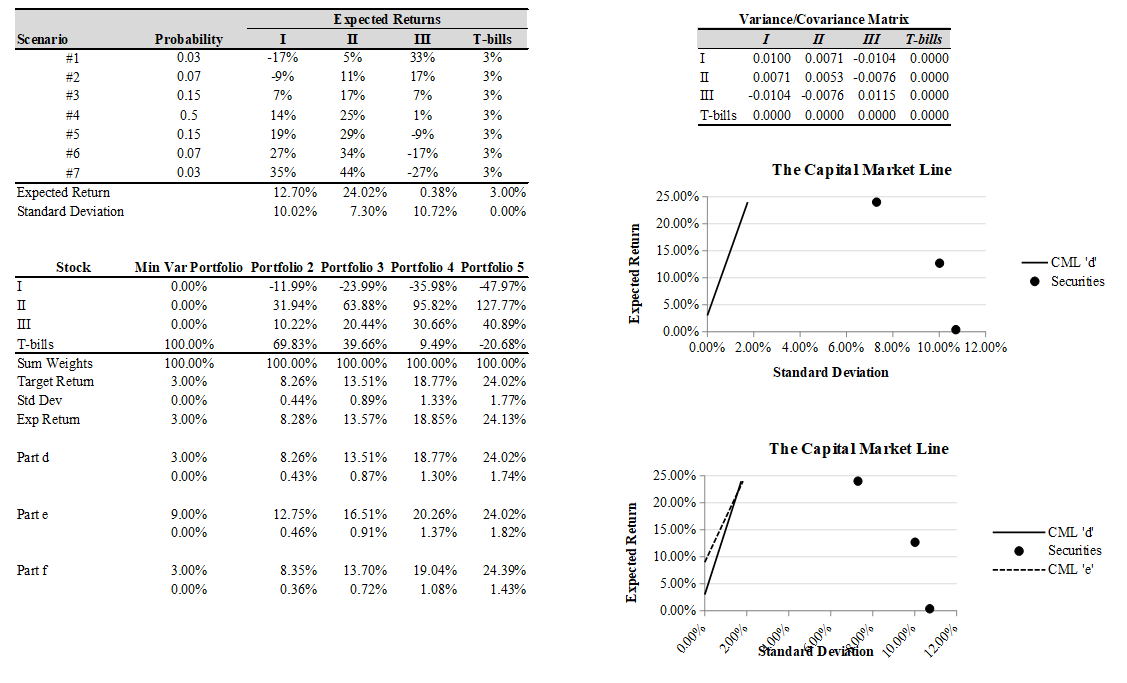

a) Determine the expected return and standard deviation of each security.

b) Calculate a variance and covariance matrix for these four securities using the given probabilities.

c) Calculate a set of five portfolios that make up the capital market line using the Solver.

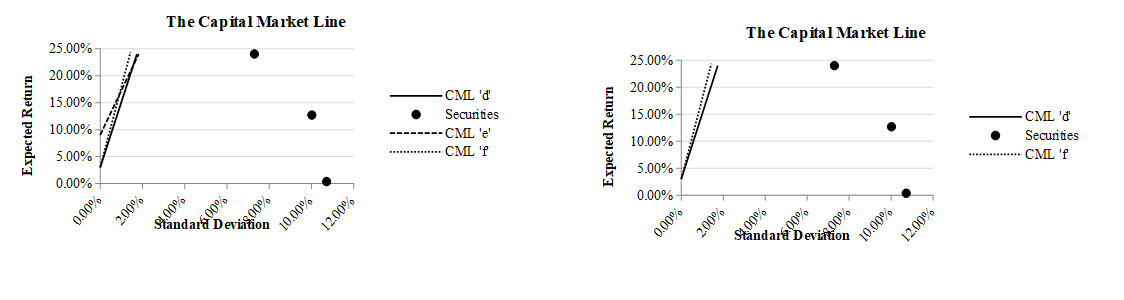

d) Create a chart of the CML including the original securities.

e) Repeat part (c) using a T-bill of 9% and include your results in the chart of part (d).

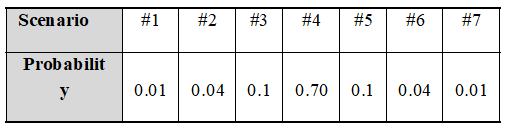

f) Repeat part (c) using the original T-bill rate but the using the following probability for each scenario:

And include your results in the chart of part (d).

You might also like to view...

If a fixed asset with a book value of $10,000 is traded for a similar fixed asset, a trade-in allowance of $15,000 isgranted by the seller, and the transaction is deemed to have commercial substance, the buyer would report a gainon exchange of fixed assets of $5,000

a. True b. False Indicate whether the statement is true or false

A company is ______ if it violates the basic rights of its employees and ignores health, safety, and environmental standards.

A. unfair B. efficient C. fraudulent D. unethical

The internal processes at Southwest Airlines are highly efficient, giving it a competitive advantage over other airlines. Southwest has a very efficient maintenance process and also has a very simple process of booking passengers. Because of these efficiencies, the company is able to offer customers an appealing mileage-driven pricing structure while also increasing the airline's profit margin. In this scenario, Southwest's competitive advantage is based on ________.

A. value ratio B. price perception C. cost leadership D. quality E. service

A ________ is also called "the brain" of the computer.

A. thumb drive B. central processing unit C. motherboard D. network card E. CMOS