According to Michael Hammer, what are the seven "deadly sins" of performance measure to avoid?

What will be an ideal response?

Business consultant Michael Hammer has identified seven "deadly sins" of performance measurement to avoid:

• Vanity: Using measures that make managers and the organization look good.

• Provincialism: Limiting measures to functional/departmental responsibilities rather than the organization's overall objectives.

• Narcissism: Measuring from the employee's, manager's, or company's viewpoint rather than the customer's.

• Laziness: Neglecting to expend the effort to identify what is important to measure.• Pettiness: Measuring just one component of what affects business performance.

• Inanity: Failing to consider the way standards will affect real-world human behavior and company performance.

• Frivolity: Making excuses for poor performance rather than taking performance standards seriously.

You might also like to view...

If the current ratio is 2.5 to 1, net income is $6,000, and current liabilities are $18,000, how much is working capital?

a. $ 6,000 b. $ 24,000 c. $ 27,000 d. $ 45,000

The ________ is a set of programs or instructions that drive the computer to perform the work desired.

A) network B) hardware C) software D) router

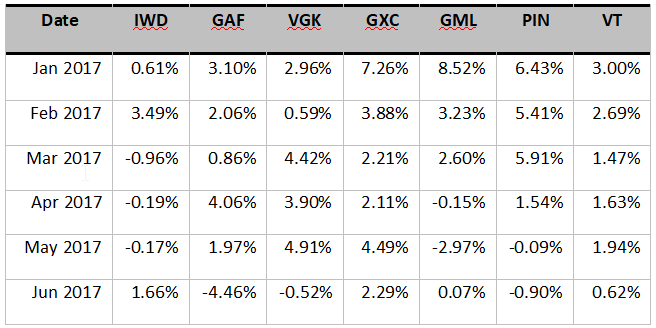

Being frustrated about the performance of your portfolio, you decide to verify the benefits of international diversification. You have selected several exchange-traded funds (ETFs) that invest in equity market indices of several world regions, including a world equity index, in an attempt to evaluate a well-diversified international portfolio. The regions you have selected are the following: Latin America (GML), Middle East & Africa (GAF), Europe (VGK), China (GXC), India (PIN), U.S. (IWD), and the entire world (VT). You have gathered the monthly returns of these ETFs from January to June 2017. The returns are in the following table:

a) Determine the average returns and standard deviations of each ETF. Also, determine the correlation coefficient and covariance of the American ETF (IWD) with the other ETFs of the rest of the world.

b) Determine the best and worst performer on a risk/return basis during this period. Use the Sharp ratio and assume that the relevant risk-free rate was 3%.

c) What is the expected return and standard deviation for an equally weighted portfolio that includes all ETFs except VT (world index ETF)? Are these results similar to those of VT?

d) Using the Solver, what is the minimum standard deviation that could be achieved by combining these ETFs into a portfolio, with the exception of VT? What are the exact weights of these ETFs? Assume short sales are not allowed.

A security agreement must contain a description of the collateral that reasonably identifies it.

Answer the following statement true (T) or false (F)