Banks considered "too big to fail" were:

A. bailed out through fiscal policy.

B. bailed out through consumer spending.

C. allowed to go bankrupt.

D. helped by fiscal policy, but eventually went bankrupt.

A. bailed out through fiscal policy.

You might also like to view...

In the short run, the relevant costs for a firm to consider whether to shut down production are:

A. average total costs. B. average variable costs. C. average fixed costs. D. fixed costs.

In perfect competition, as the long run approaches, economic losses will cause

a. the exit of existing firms, shifting the market supply curve to the left b. government regulation c. technological innovation d. inflation e. a favorable shift in tastes and preferences

The deadweight loss associated with a tax on a commodity is generated by

a. the consumers who still choose to consume the commodity but pay a higher price that reflects the tax. b. the consumers who choose to not consume the commodity that is taxed. c. all citizens who are able to use services provided by government. d. the consumers who are unable to avoid paying the tax.

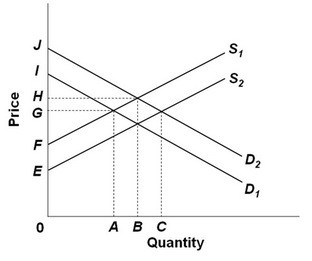

Refer to the above supply and demand graph. Point A represents the current equilibrium level of output of this product and point B represents the optimal level of output from society's perspective. If government decides to correct this externality with a subsidy to consumers, then the:

Refer to the above supply and demand graph. Point A represents the current equilibrium level of output of this product and point B represents the optimal level of output from society's perspective. If government decides to correct this externality with a subsidy to consumers, then the:

A. demand curve will shift from D2 to D1. B. demand curve will shift from D1 to D2. C. supply curve will shift from S1 to S2. D. supply curve will shift from S2 to S1.