List the four stages of the product life cycle and discuss the typical characteristics for each stage.

What will be an ideal response?

The INTRODUCTORY STAGE is characterized by a high failure rate, little competition, frequent product modification, limited distribution, high marketing and production costs, negative profits, and promotion that stimulates primary demand.

The GROWTH STAGE is characterized by increased sales, new competitors, healthy profits that peak, aggressive brand promotion, expanded distribution, price reductions, and possible acquisitions.

The MATURITY STAGE is characterized by a peak in sales, lengthened product lines, style modifications, price reductions, falling profits, competitor turnover, heavy promotion, and brand "wars."

The DECLINE STAGE is characterized by a long-run drop in sales and profits, less demand, widespread competitor failure, reduction of advertising costs, and possible elimination of the product.

You might also like to view...

Allen Company's master budget called for 50,00 . units of production. Budgeted direct material costs at this level were $450,00 . or $9 per unit. Allen actually produced 54,00 . units and incurred direct material costs of $496,000 . What is Allen's direct material variance using flexible budgeting?

a. $10,00 . U b. $46,00 . U c. $36,00 . U d. $10,00 . F

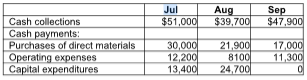

The cash balance on June 30 is projected to be $4500. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 4%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. Calculate the amount of principal repayment at the

Burchfield, Inc. has prepared its third quarter budget and provided the following data:

A) $5,000

B) $10,000

C) $15,000

D) $20,000

Mitchell Corporation's accounting records include the following items for the year ending December 31, 2017

Gain on Sale of Equipment $12,000 Gain on Discontinued Operations $75,000 Loss on Disposal of Equipment 5,000 Extraordinary Loss 15,000 Net Sales 650,000 Cost of Goods Sold 285,000 Operating Expenses 120,000 The income tax rate for the company is 45%. The company had 15,000 shares of common stock outstanding during 2017 and no preferred stock. Prepare Mitchell's income statement for the year ending December 31, 2017. Show how Mitchell reports EPS data on its 2017 income statement. What will be an ideal response

31.5 is 10.5% of what number?

A) 300 B) 32 C) 33 D) 35