The first column of the following table describes the price movement of AOL Corporation stock over a five-year period. The second column gives the period's consumer price index

Calculate the real value of the stock for each time period using year 5 as the base year. If you purchased $1,000 worth of AOL Corporation in year 1, what has happened to the purchasing power of your original $1,000 investment when you sell the stock in year 5? Year AOL CPI 1996 $4.00 147.8 1997 $3.84 155.3 1998 $7.00 163.0 1999 $37.00 165.4 2000 $70.00 172.1

Year Real AOL Stock Price in 2000 Dollars

1996 $4.66

1997 $4.26

1998 $7.39

1999 $38.50

2000 $70.00

The real value of a year 1996 dollar in 2000 is 172.1($1)/147.8 = $1.16. I would have bought 250 shares of AOL at 1996 prices (ignoring transaction costs) with the $1,000. The value of the stock in the year 2000 is (250($70)) = $17,500. The change in my purchasing power is

($17,500 - $1,160)/$1,160 = 14.09. That is, my purchasing power from investing in the stock rises by 1,409%.

You might also like to view...

All of the following would be included in aggregate expenditure except

A. social security payments. B. changes in inventories. C. sales of domestically produced goods to foreigners. D. purchases of services provided by government employees.

The task of economic regulation is to

a. protect monopoly profits b. approximate the results of the competitive market c. replace competition with government ownership d. ensure laissez-faire e. increase competition within the market

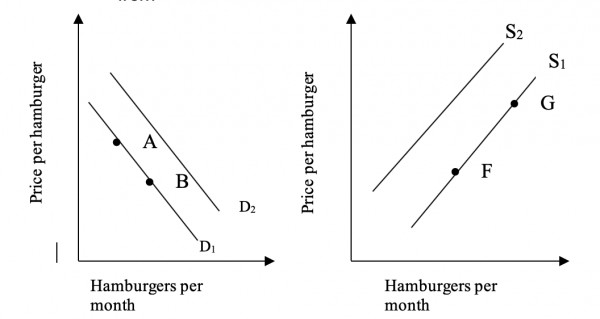

Assume hamburgers and french fries are complements. A decrease in the price of french fries will cause a movement from

A) Point A to Point B.

B) Point G to Point F.

C) D1 to D2.

D) S2 to S1.

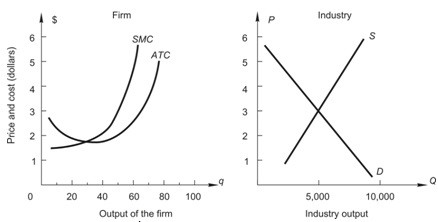

Below, the graph on the left shows the short-run cost curves for a firm in a perfectly competitive market, and the graph on the right shows the current market conditions in this industry. In order to maximize profit, how much output should the firm produce?

A. 60 units B. 80 units C. 20 units D. 40 units E. 50 units