Jaakola Corporation makes a product with the following costs: Per UnitPer YearDirect materials$17.00 Direct labor$22.00 Variable manufacturing overhead$4.00 Fixed manufacturing overhead $504,000 Variable selling and administrative expenses$4.90 Fixed selling and administrative expenses $319,200 ?The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 28,000 units per year. The company has invested $360,000 in this product and expects a return on investment of 15%. The markup on absorption cost would be closest to:

A. 27.1%

B. 15.0%

C. 84.3%

D. 29.9%

Answer: D

You might also like to view...

The ________ allows employees to sue employers that violate employment laws.

A. United States Chamber of Commerce B. National Chamber Foundation C. Institute for a Competitive Workforce D. Equal Employment Opportunity Commission E. Center for Capital Markets Competitiveness

Describe geofencing.

What will be an ideal response?

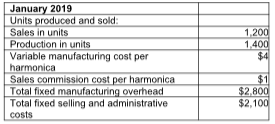

1. Compute the product cost per harmonica produced under absorption costing. 2. Prepare an income statement for January, 2019

Louie's Music produces harmonicas that it sells for $12 each. The company computes a

new monthly fixed manufacturing overhead allocation rate based on the planned number

of harmonicas to be produced that month. Assume all costs and production levels are

exactly as planned. The following data are from Louie's Music's first month in business:

Putting yourself in the receiver's shoes to better adapt your message to that person's needs is called ____________________

Fill in the blank(s) with correct word