Graphically illustrate and explain what effect a sale of bonds by the Federal Reserve will have on the money market

What will be an ideal response?

A Fed purchase of bonds will cause a decrease in H and an decrease in the money supply. At the initial interest rate, there will be an excess demand for money. The interest rate will increase to restore money market equilibrium. All else fixed, there will be no change in money demand.

You might also like to view...

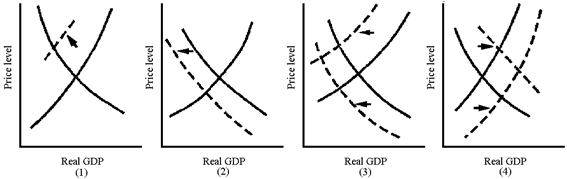

Aggregate demand and supply curves have been widely used to analyze the performance of the macroeconomy. Figure 5-3 shows four diagrams that represent different changes in the macroeconomy. Choose the diagram that best represents the situations described in the following questions.Figure 5-3

A. 1 B. 2 C. 3 D. 4

The term crowding-out effect refers to

a. the reduction in aggregate supply that results when a monetary expansion causes the interest rate to decrease. b. the reduction in aggregate demand that results when a monetary expansion causes the interest rate to decrease. c. the reduction in aggregate demand that results when a fiscal expansion causes the interest rate to increase. d. the reduction in aggregate demand that results when a decrease in government spending or an increase in taxes causes the interest rate to increase.

Leaving the labor force or finding a job are two ways that:

A. an unemployment spell can end. B. a person can become a discouraged worker. C. a person can become an involuntary part-time worker. D. an unemployment spell can begin.

Who controls a sole proprietorship?

A) stockholders B) bondholders C) the owner D) all of these