In order to move the federal funds rate to the level it desires, the Fed must

A) first change the discount rate to the desired federal funds rate.

B) specify the interest rate on previously issued government bonds.

C) adjust the money supply to achieve the target federal funds rate.

D) limit the amount of bank lending activity.

Ans: C) adjust the money supply to achieve the target federal funds rate.

You might also like to view...

Consider an individual who earns $95,000, has two children, pays $6,000 in child care expenses for one child, pays $19,000 in college tuition for the other child, pays $6,500 in mortgage interest (mortgage interest is tax deductible), and pays $9,600 in medical expenses. Medical expenses in excess of 7.5 percent of one's income are deductible. Personal exemptions are $3,050 per person (including the tax filer). When the individual's income is $30,000 or above, he/she gets a 12% child care credit. A college credit of 9% of tuition costs is given to those that have income less than $90,000. Her statutory marginal tax rate is 15 percent. What is her actual or effective marginal tax rate?

What will be an ideal response?

Money is:

a. valuable because it is backed by gold. b. any items used in barter. c. an illiquid asset. d. none of these.

The greater the MPC: a. the greater the fraction of an increase in AD due to an increase in government purchases that is consumption. b. the smaller the fraction of an increase in AD due to an increase in government purchases that is consumption. c. the greater the change in government purchases required to achieve a given change in AD

d. none of the above

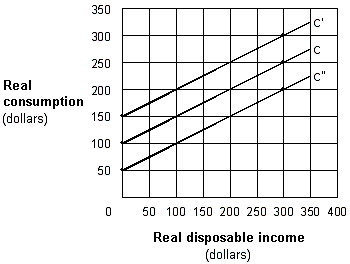

Exhibit 8-7 Consumption function

?

A. high for C' than for C. B. lower for C" than for C. C. lower for C" than for C'. D. the same for C, C', and C".