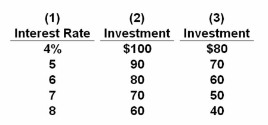

Refer to the table, in which investment is in billions. Suppose the Fed reduces the interest rate from 6 to 5 percent at a time when the investment demand declines from that shown by columns (1) and (2) to that shown by columns (1) and (3). As a result of these two occurrences, investment will:

A. increase by $10 billion.

B. decrease by $10 billion.

C. increase by $20 billion.

D. decrease by $20 billion.

B. decrease by $10 billion.

You might also like to view...

If the required reserve ratio is 20 percent, banks loan out all excess reserves, people hold no currency, and the Fed sells $5,000 worth of bonds to banks, what is the ultimate impact on the money supply?

a. The money supply will increase by $5,000. b. The money supply will decrease by $5,000. c. The money supply will increase by $25,000. d. The money supply will decrease by $25,000. e. The money supply will not change.

One characteristic of an oligopoly market structure is:

a. firms in the industry are typically characterized by very diverse product lines. b. firms in the industry have some degree of market power. c. products typically sell at a price equal to their marginal cost of production. d. the actions of one seller have no impact on the profitability of other sellers.

Productivity is a measure of

A. Input per dollar of output. B. Output per unit of input. C. Input per unit of output. D. Output per dollar of input.

A distinguishing characteristic of producers of information products is their

A) high social cost. B) short-run economies of operation. C) low average fixed costs. D) low fixed costs.