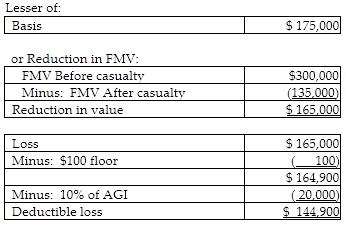

Jarrett owns a mountain chalet that he purchased in 2008 for $175,000. This year, the home appraised at $300,000. Shortly after the appraisal, a severe blizzard hit the area in spring of the current year, destroying trees and severely damaging several homes, including Jarrett's chalet. The blizzard was declared a federal disaster. The chalet's value was reduced to $135,000. Jarrett does not have

insurance. Jarrett's AGI is $200,000. Jarrett's deductible loss after limitations is

A) $135,000.

B) $144,900.

C) $164,900.

D) $165,000.

B) $144,900.

You might also like to view...

Ethics training programs by incorporating global issues serve the utilitarian need of doing the greatest good for the greatest number. Which of the following are not global issues?

a. Human rights b. Environmental sustainability c. Salary and financial benefits d. Economic development

Jeannie carelessly packed her grandmother's antique glassware and had it shipped to her 30-year-old daughter, Abby, via Common Freight Carriers. When the china arrived at Abby's house, most of the pieces were broken. As between Jeannie and Common Freight Carriers, who will bear the loss?

a. Under the Carmack Amendment, Jeannie is liable for the loss if Common Freight Carriers shows it was not negligent and that the loss was caused by Jeannie's failure to wrap and pack the glassware properly. b. Under the Carmack Amendment, Common Freight Carriers is liable. A common carrier is strictly liable. c. Under the Carmack Amendment, Common Freight Carriers is liable because of its negligence in not inspecting Jeannie's packing job. d. Liability is governed by state statute and will depend on which state law will control.

The forecast error measures the difference between the forecast and the estimate

Indicate whether the statement is true or false.

On March 1, 2016, Vantage Services issued a 8% long-term notes payable for $22,000

It is payable over a 16-year term in $1,375 principal installments on March 1 of each year, beginning March 1, 2017. Each yearly installment will include both principal repayment of $1,375 and interest payment for the preceding one-year period. The journal entry to pay the first installment will include a debit to Interest Expense for $1,760. Indicate whether the statement is true or false