FICA taxes include:

A. Federal and state unemployment taxes.

B. Employee federal income tax.

C. Charitable giving.

D. Employee state income tax.

E. Social Security and Medicare taxes.

Answer: E

You might also like to view...

A potential liability that may become a real liability, depending on future events, is called a continuous liability

Indicate whether the statement is true or false

Which of the following is a type of off-price retailer?

A) specialty store B) full-service retailer C) discount store D) warehouse club E) supermarket

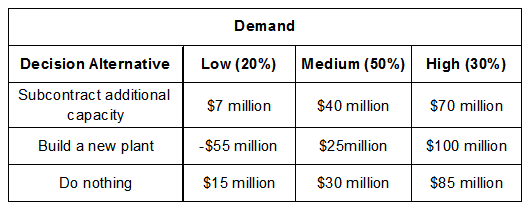

XYZ is a paint product manufacturer, and one of the plants is experiencing a substantial increase in demand. The future demand for the products could be low, medium, or high, with probabilities estimated to be 25%, 50%, and 30%, respectively. The company wants to determine the financial impact associated with the three decision alternatives under the varying levels of demand. Given the following payoff matrix, the firm’s manager should ______.

a. subcontract additional capacity.

b. build a new plant.

c. do nothing.

d. expand the plant.

Give an example of an option to abandon a project. Why might this be of value?

What will be an ideal response?