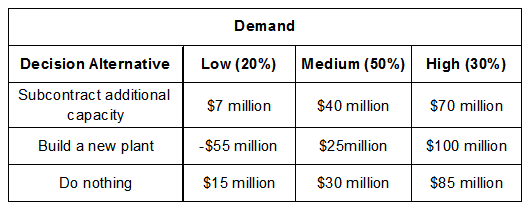

XYZ is a paint product manufacturer, and one of the plants is experiencing a substantial increase in demand. The future demand for the products could be low, medium, or high, with probabilities estimated to be 25%, 50%, and 30%, respectively. The company wants to determine the financial impact associated with the three decision alternatives under the varying levels of demand. Given the following payoff matrix, the firm’s manager should ______.

a. subcontract additional capacity.

b. build a new plant.

c. do nothing.

d. expand the plant.

c. do nothing.

You might also like to view...

Receiving payment prior to delivering goods or services causes a current liability to be incurred

a. True b. False Indicate whether the statement is true or false

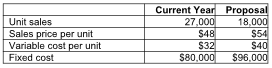

Relative to the current year, the sales manager's proposal will ________.

Alvarez Company is facing an $8 increase in the variable costs of producing one of its products for the upcoming year. As a result, the sales manager has made a proposal to increase the sales price of the product while increasing the advertising budget at the same time. The sales price increase will lower sales volume, but the other changes may help the company maintain its profit margin. Alvarez has provided the following information regarding the current year results and the proposal made by the sales manager:

A) decrease operating income by $324,000

B) increase contribution margin by $196,000

C) decrease the unit breakeven point

D) decrease operating income by $196,000

We can capture the essence of the concepts in our definition of value in a _______

a. customer value in business markets b. fundamental value equation c. estimate of value d. estimate of value changes

A cash-based measure to help business decision makers estimate the amount and timing of cash flows from operating activities is the cash flow on total assets ratio.

Answer the following statement true (T) or false (F)