Describe the penalties for undervaluing gifts on a gift tax return.

What will be an ideal response?

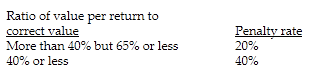

Sec. 6662 imposes a penalty, at one of two rates, on underpayment of gift or estate taxes resulting from too low a valuation of property. The penalty is imposed on the amount of the transfer tax understatement. If the valuation shown on the tax return exceeds 65% of the valuation determined upon audit or court trial, there is no penalty. If the value reported on the return is 65% or less of the correct value, the penalty rate is:

A taxpayer is exempt from the penalty if the underpayment is less than $5,000. The IRS will not levy the penalty if the taxpayer shows good faith and reasonable cause.

You might also like to view...

According to the VALS system developed by SRI International, ________ are mature, satisfied comfortable people who value order, knowledge and responsibility

A) strivers B) innovators C) thinkers D) believers

The reengineering process makes it possible to determine how much each change contributed to the organization's improved position.

Answer the following statement true (T) or false (F)

What is the difference between training and employee development?

What will be an ideal response?

Overhead is applied on standard labor hours. (Round interim calculations to the nearest cent.) The direct labor time variance is

A. $33,000 favorable B. $6,000 unfavorable C. $33,000 unfavorable D. $6,000 favorable