Anthem Corporation has excess cash to invest and pays $200,000 to buy 7%, five-year bonds of Richmond Corporation, at face value, on June 30, 2016

The bonds pay interest on June 30 and December 31. At the date of purchase, Anthem intended to hold the bonds to maturity. The bonds are disposed of, at face value, on June 30, 2021.

Prepare the journal entry for (omit the explanation) June 30, 2021 (assume that the last interest payment has already been recorded).

What will be an ideal response

2021

June 30 Cash 200,000

Long-term Investments — Held-to-Maturity 200,000

You might also like to view...

The objective and task method of budgeting marketing communications links dollars to specific marketing or communication goals

Indicate whether the statement is true or false

Which type of investment in securities must always be classified as a current asset?

A) held-to-maturity debt securities B) available-for-sale securities C) trading securities D) none of the these, they may all be classified as current or long-term assets

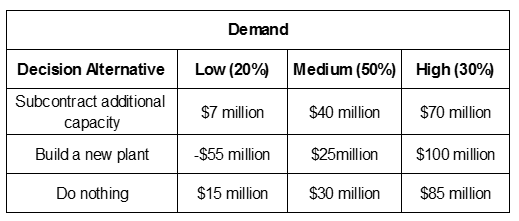

XYZ is a paint product manufacturer, and one of the plants is experiencing a substantial increase in demand. The future demand for the products could be low, medium, or high, with probabilities estimated to be 25%, 50%, and 30%, respectively. The company wants to determine the financial impact associated with the three decision alternatives under the varying levels of demand. Given the following payoff matrix, determine the EV for the option of building a new plant.

A. $ 42.4 million

B. $31.5 million

C. $43.5 million

D. $23.5 million

A publisher of books on holiday decorating, cooking, and crafts has to find a way to dispose of its overrun and unsold end-of-season output. As a marketing consultant, you suggest the firm sell the merchandise to:

A. mass merchandisers B. convenience stores C. department stores D. supermarkets E. off-price discount retailers