A bank reports reserves of $100,000, government securities of $50,000, loans of $750,000, and checkable deposits of $900,000. The desired reserve ratio is 10 percent. What is the amount of excess reserves for this bank? Show your work

What will be an ideal response?

Excess reserves equal the actual reserves minus the desired reserves. The actual reserves are $100,000. The bank wants to keep 10 percent of its checkable deposits as reserves, so the desired reserves are ($900,000 ) × 0.10 = $90,000. So excess reserves equal $100,000 - $90,000 = $10,000.

You might also like to view...

If a tax on 5 cents a tomato lowers the price received by tomato sellers by 5 cents a tomato , then the supply of tomatoes is perfectly ___ and the seller pays ____

A) inelastic; all B) elastic; all C) inelastic; some of D) inelastic; none of E) elastic; none of

The expression "increase in quantity supplied" is illustrated graphically as a

A) leftward shift in the supply curve. B) rightward shift in the supply curve. C) movement up along the supply curve. D) movement down along the supply curve.

Macroeconomists are able to study the entire economy by

a. ignoring much of the data available in order to reduce the number of markets that need to be studied b. studying only a few markets at a time c. simply adding up all the prices and quantities in individual markets d. aggregation which reduces the number of markets that need to be studied e. dividing total output by the number of markets

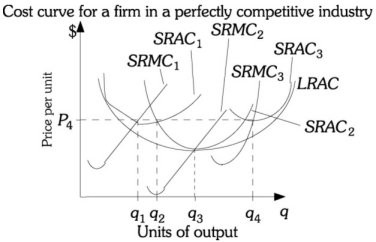

Refer to the information provided in Figure 9.6 below to answer the question(s) that follow.  Figure 9.6Refer to Figure 9.6. Assume this firm is in a constant-cost industry. For this firm to be in long-run equilibrium, the firm must be producing

Figure 9.6Refer to Figure 9.6. Assume this firm is in a constant-cost industry. For this firm to be in long-run equilibrium, the firm must be producing

A. q1 units of output. B. q2 units of output. C. q3 units of output. D. an amount that is indeterminate from this information.