The average tax rate is the rate at which an additional dollar earned is taxed

a. True

b. False

Indicate whether the statement is true or false

False

You might also like to view...

Unless demand is changing, price and quantity will

A) be proportionate. B) move in opposite directions. C) move in the same direction. D) fluctuate cyclically. E) remain constant.

Which of the following statements is CORRECT?

A) When demand increases, both the price and the quantity increase. B) When demand decreases, the price rises and the quantity decreases. C) When supply increases, the quantity decreases and the price rises. D) When supply decreases, both the price and the quantity decrease.

Which of the following will most likely provide fiscal stimulus to the economy?

A. Decreasing government spending on goods and services. B. Increasing transfer payments. C. Higher interest rates. D. Increasing taxes.

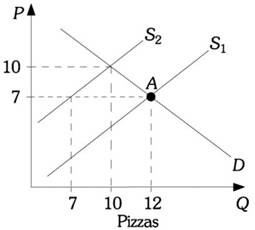

Refer to the information provided in Figure 5.6 below to answer the question that follows. Figure 5.6Refer to Figure 5.6. The market is initially in equilibrium at the intersection of the demand curve and supply curve S2. If supply shifts from S2 to S1, which of the following statements is true?

Figure 5.6Refer to Figure 5.6. The market is initially in equilibrium at the intersection of the demand curve and supply curve S2. If supply shifts from S2 to S1, which of the following statements is true?

A. The market cannot move to a new equilibrium unless demand shifts at the same time that supply shifts. B. There is no need for price to serve as a rationing device in this case because the new equilibrium quantity is less than the original equilibrium quantity. C. Price will still serve as a rationing device causing quantity demanded to rise from 10 to 12 pizzas. D. Price will still serve as a rationing device causing quantity supplied to exceed 12 pizzas.