A progressive income tax means that those with a higher income pay

A. a higher percentage of their income in taxes than low-income people.

B. the same percentage of their income in taxes as low-income people.

C. a lower percentage of their income in taxes than low-income people.

D. all the taxes in the economy.

Answer: A

You might also like to view...

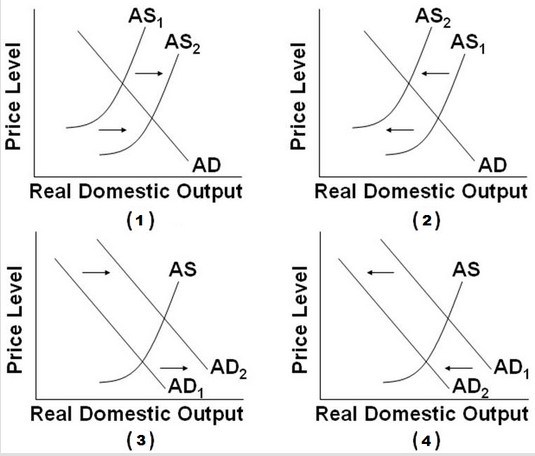

Use the following diagrams for the U.S. economy to answer the next question. If the economy is initially at full employment, which of the diagrams best portrays a recession as a result of an increase in the cost of production?

If the economy is initially at full employment, which of the diagrams best portrays a recession as a result of an increase in the cost of production?

A. Graph (1) B. Graph (2) C. Graph (3) D. Graph (4)

If the individuals in a group of consumers all have homothetic tastes, then we can treat the group as a single representative consumer.

Answer the following statement true (T) or false (F)

Which of the following is the best example of a perfectly competitive firm?

A) a Taco Bell restaurant B) United Parcel Service (UPS) C) a corn farmer in Illinois D) the Ford Motor Company

Using time-series data, the demand function for a profit-maximizing monopolist has been estimated asQd = 142,000 - 500P + 6M - 400PRwhere Qd is the amount sold, P is price, M is income, and PR is the price of a related good. The estimated values for M and PR in 2014 are $25,000 and $200, respectively. The short-run marginal cost curve for this firm has been estimated as:MC = 200 - 0.024Q + 0.000006Q2Total fixed cost is forecast to be $500,000 in 2016. What is the value of average variable cost at the optimal level of output?

A. $196 B. $112 C. $96 D. $232 E. $76