Explain how a country whose currency is the reserve currency can use monetary policy for macroeconomic stabilization. In particular, explain the result if that country doubled its domestic money supply

What will be an ideal response?

The immediate result of the doubling of the money supply in the reserve currency's country will be able to increase the exchange rate between the reserve currency and all other currencies. However, all other countries must fix their exchange rate to the reserve currency, so they will purchase the reserve currency and hold it as official international reserves (thus increase their own money supply) until the exchange rate has returned to normal. Thus, the reserve country has the power to affect its own economy and all other countries must adjust in response.

You might also like to view...

If in a perfectly competitive industry, the market price facing a firm is below its average total cost but above average variable cost at the output where marginal cost equals marginal revenue

A) the industry supply will not change. B) firms are breaking even. C) some existing firms will exit the industry. D) new firms are attracted to the industry.

The legal system is an example of:

A. human capital. B. social capital. C. entrepreneurial capital. D. physical capital.

In a currency swap two parties agree to exchange flows of different bonds during a specified time period.

Answer the following statement true (T) or false (F)

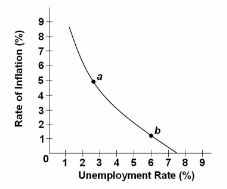

Refer to the diagram for a specific economy. The curve on this graph is known as a:

A. Laffer Curve.

B. Phillips Curve.

C. labor demand curve.

D. production possibilities curve.