Suppose you have put $5,000 into a project that should generate cash inflows of $1,250 for each of the next 5 years. If the interest rate is 8% is this a good investment?

A. Yes, because you will earn a profit of $1,250 dollars in 5 years

B. Yes, because the internal rate of return is higher than the interest rate

C. No, because the internal rate of return is higher than the interest rate

D. No, because the net present value is negative

D. No, because the net present value is negative

You might also like to view...

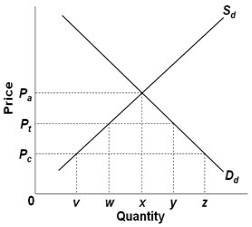

Use the following graph, where Sd and Dd are the domestic supply and demand for a product and Pc is the world price of that product, to answer the next question. If this economy was entirely closed to international trade, equilibrium price and quantity would be

If this economy was entirely closed to international trade, equilibrium price and quantity would be

A. Pa and x. B. Pc and z. C. Pa and z. D. Pc and v.

During 2012, a country has consumption expenditures of $3.0 trillion, investment expenditures of $1.5 trillion, government expenditure of $1.5 trillion, exports of $1.0 trillion, and imports of $1.5 trillion

Aggregate expenditure for the country is A) $5.5 trillion. B) $6.5 trillion. C) $6.0 trillion. D) $8.5 trillion. E) $7.0 trillion.

Define logrolling. Explain why logrolling often results in legislation that benefits the economic interests of a few, while harming the interests of a larger group of people

What will be an ideal response?

Which of the following would NOT affect a good's price elasticity of demand?

A) the ease of substitution between goods B) the cost of producing the good C) the number of substitute goods available D) the proportion of one's budget spent on an item