Which of the following statements is true?

A) Interest on bonds is tax deductible.

B) Interest on bonds is not tax deductible.

C) Dividends to stockholders are tax deductible.

D) Bonds do not have to be repaid.

E) Bonds always increase return on equity.

A) Interest on bonds is tax deductible.

You might also like to view...

Using anthropological methods for advertising research typically includes:

A) a statistical analysis B) a sociological study C) direct observation D) secondary research

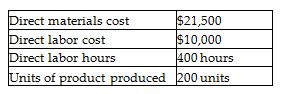

Irene Manufacturing uses a predetermined overhead allocation rate based on direct labor cost. At the beginning of the year, the company estimated total manufacturing overhead costs at $1,020,000 and total direct labor costs at $820,000. In June, Job 711 was completed. The details of Job 711 are shown below.

How much was the cost per unit of finished product? (Round any percentages to two decimal places and your final answer to the nearest cent.)

A) $157.50

B) $197.70

C) $169.70

D) $219.70

The use of major credit cards does not require sellers to establish the customer's credit

Indicate whether the statement is true or false

While conducting an orientation session for new employees, Clayton noticed looks of confusion on the faces of some listeners. He then paused and asked his audience, "What questions do you have so far?" Clayton was striving to overcome communication barriers by ________

A) questioning his assumptions, biases, and prejudices B) improving his language and listening skills C) creating an environment for useful feedback D) reducing physical distractions