Explain how corporate profits are taxed twice

What will be an ideal response?

Corporate profits are taxed by the corporate income tax first. Second, dividends paid out of profits are taxed as personal income of the stockholders. If the company does not pay dividends but the value of the stock goes up, the stockholder will pay capital gains tax when he or she sells the stock.

You might also like to view...

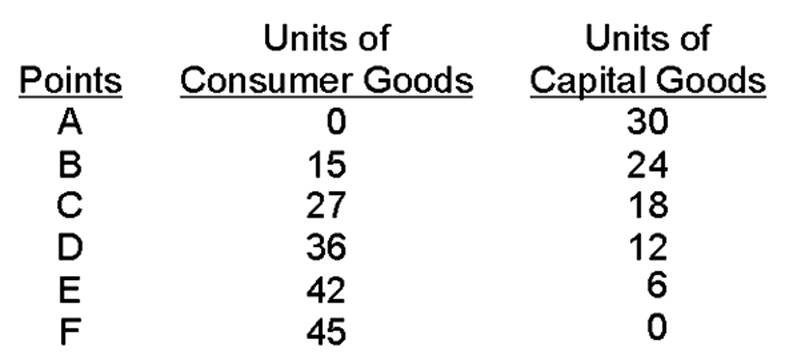

What is the opportunity cost of moving from point D to point C?

Among the sources of economic inefficiency are all of the following EXCEPT

A) price regulations. B) rapid technological change. C) monopoly. D) taxes and subsidies.

When your outcomes depend on another's choices, asking ________ is the key to good decision making.

A. what the wants and constraints are of those involved B. what the trade-offs are C. how will others respond D. why everyone isn't already doing it

Unemployment compensation is available to:

A. people who are out of work through no fault of their own regardless of previous employment history. B. anyone who is unemployed for an unlimited duration. C. anyone who is unemployed but for a limited duration. D. people who are out of work through no fault of their own and have worked in a covered occupation for a substantial number of weeks in the period just before they became unemployed.